Overview

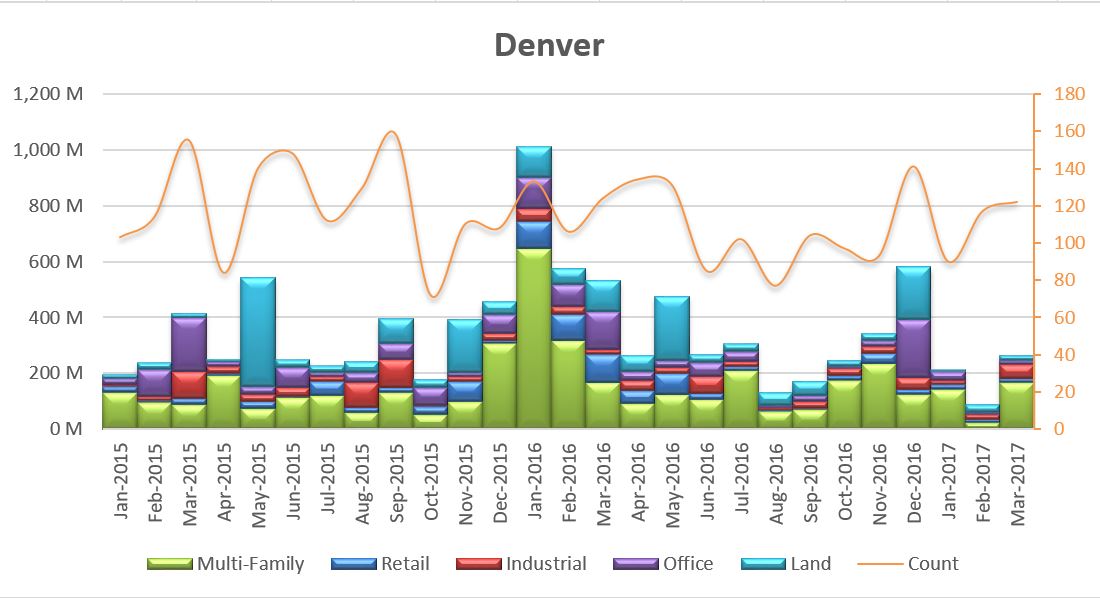

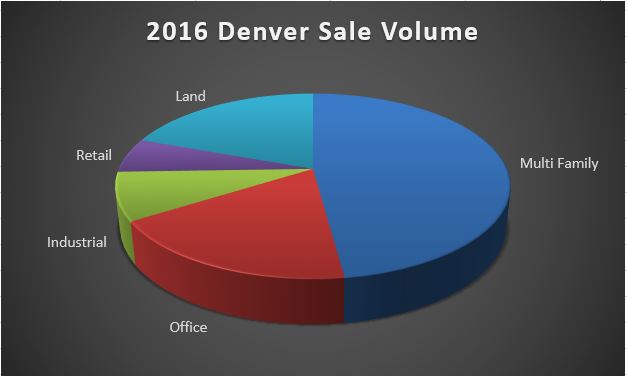

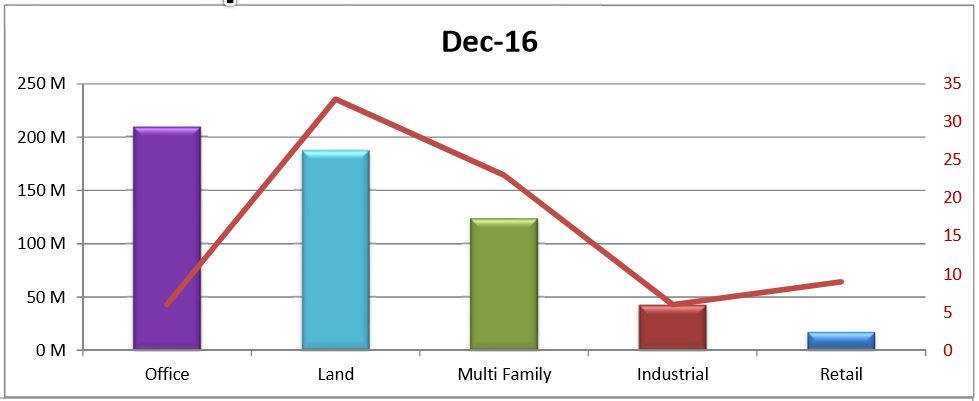

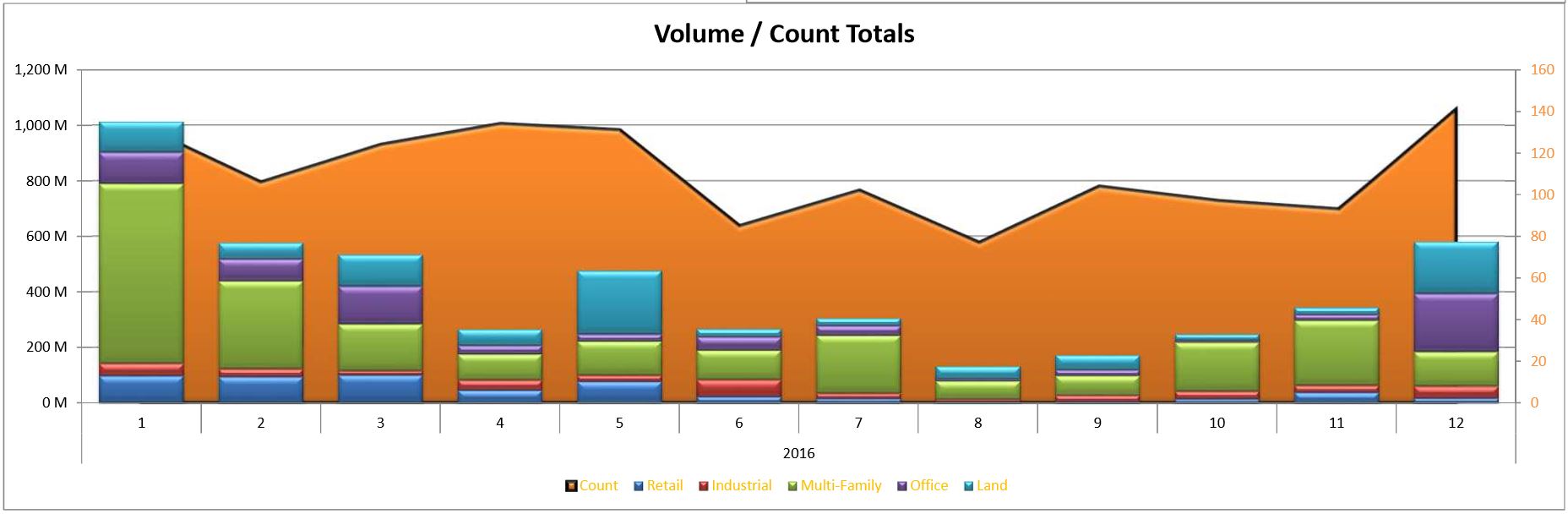

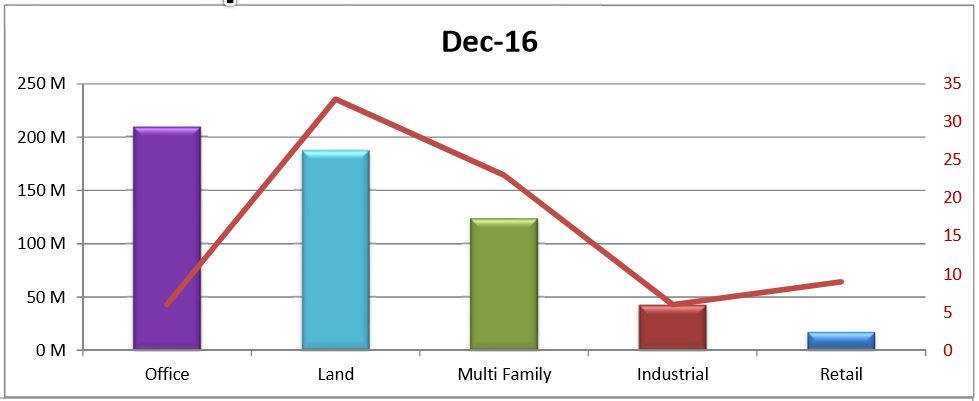

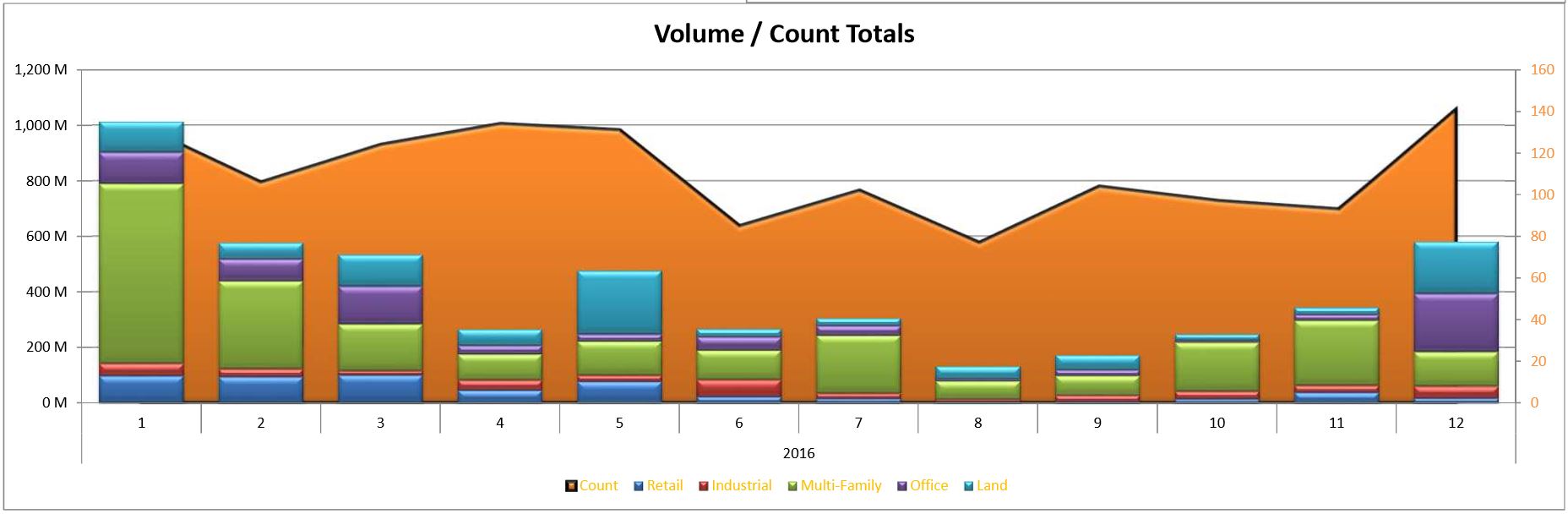

While office space lead the way for December, multi family properties accounted for just over 47% of all the gross transactions (sales) in Denver county for the year. December, also showed favorable for land transactions. The month of May was the only other month of the year that had greater volume of land transactions than December.

Both the volume and transaction count lead the pack for multi family transactions and land. In fact, in terms of the number of total transactions across all property times, multi family and land transactions accounted for just over 69% of all sales transactions in Denver county.

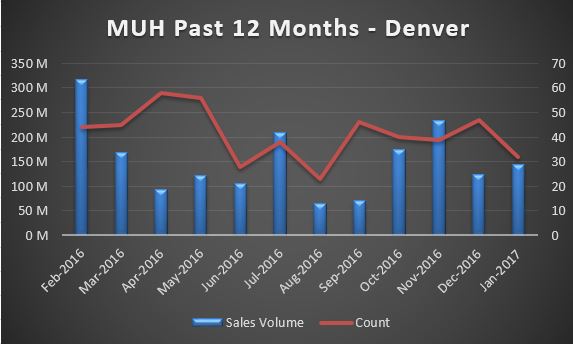

Multi Family

No doubt, multi family leads the way in Denver commercial real estate for 2016. There were 524 transactions, and $2.3 billion it total volume for the year. This accounts for 47% of the total commercial volume, and 39% of the transaction count for 2016.

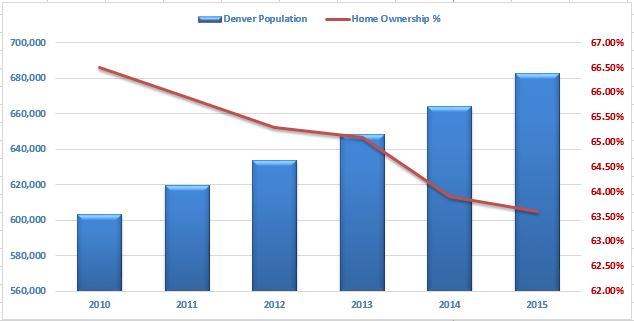

There is allot of conversation as to why this is, and I boil it down to three primary things: 1. Population Growth 2. Employment 3. Construction Defects I will dive more into this analysis in next months news letter, but the quick explanation is that as we grow in population and employment we need more homes which have been limited.

Office

Office transaction accounted for just under $739 million in 2016 which is 11% of the total commercial volume for the year. There were 130 transactions which makes the transaction count 10% of the total transactions for the year. December was the record month for the past two years. This is primarily due to a transaction that took place with one specific property that sold near the Convention Center for just over $154 million. That makes this single transaction 3% of the total commercial space for the year (in terms of sales value), and 21% of the office segment for the year.

Industrial

The total count for 2016 industrial transaction was 151 with a sales volume of just over $352 million. This makes the industrial space only 7% of the total commercial transaction volume, and 11% of the total count for the year.

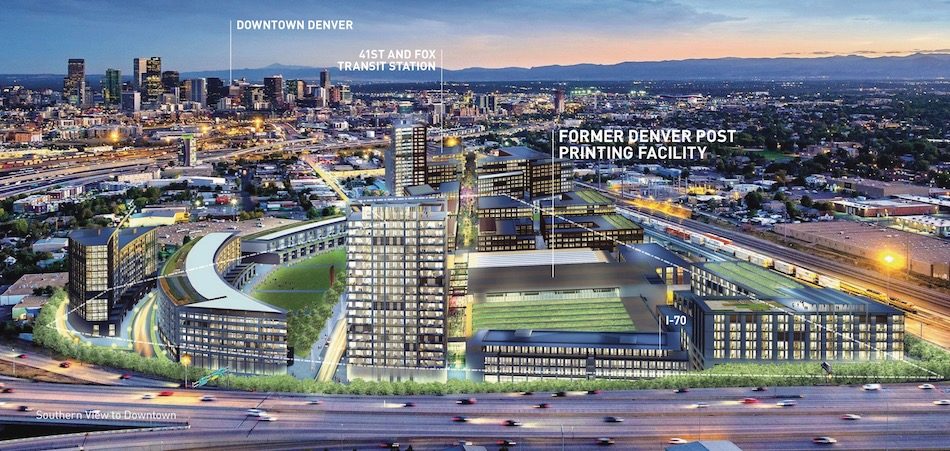

The big news for Denver industrial space is that Amazon has announced it will be opening a 1 million square foot fulfillment center in the area -this will have an impact to the industrial space for 2017.

Retail

In Denver county, retail transactions accounted for 11% of the over all commercial volume of just under $816 million. County records show a total of 127 transactions which makes it only only 10% of the total number of transaction that took place in 2016.

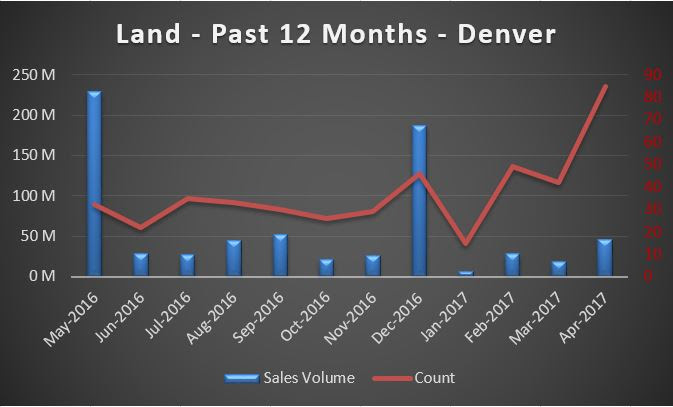

Land

There were a total count of 395 transactions categorized for land within Denver county for 2016, and a total of just under $958 million in volume. This accounts for 19% of the total commercial volume for the year, and 30% of total transaction count. While it may look like the record month for land volume was in December, May actually beet the volume by just under $41 million.

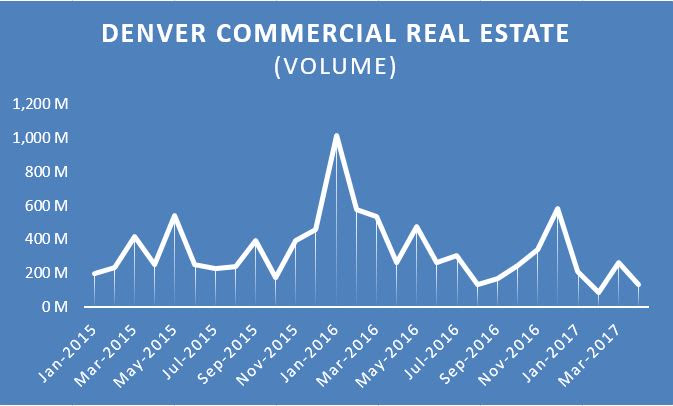

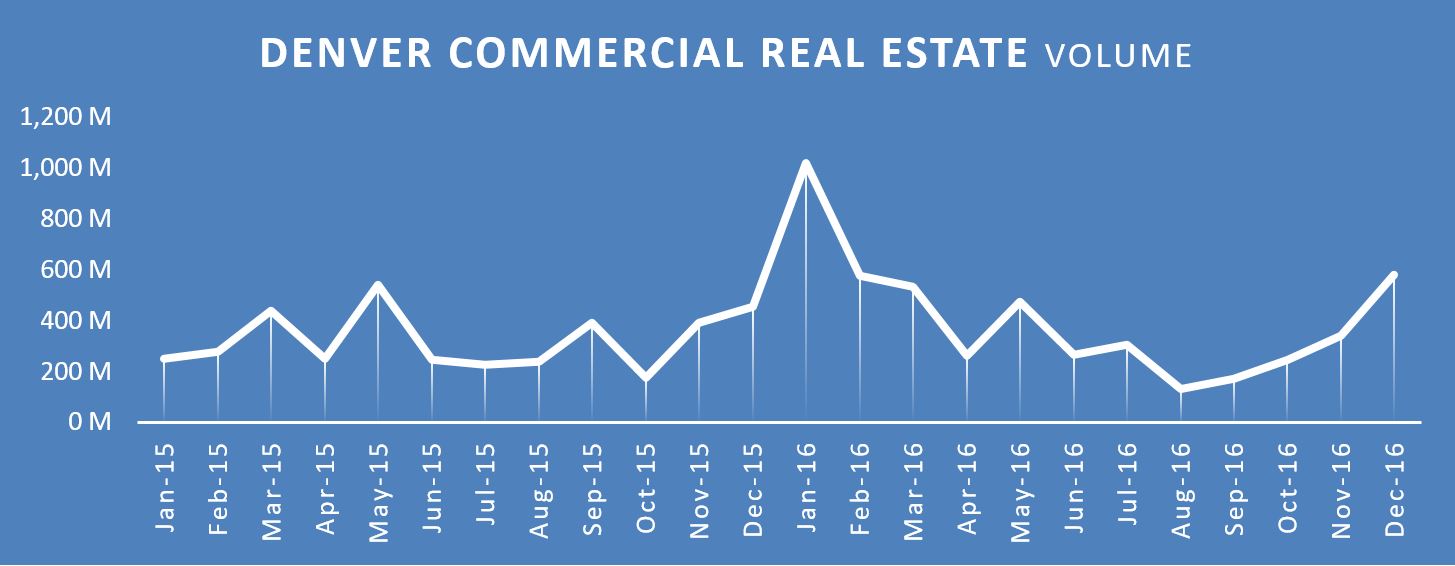

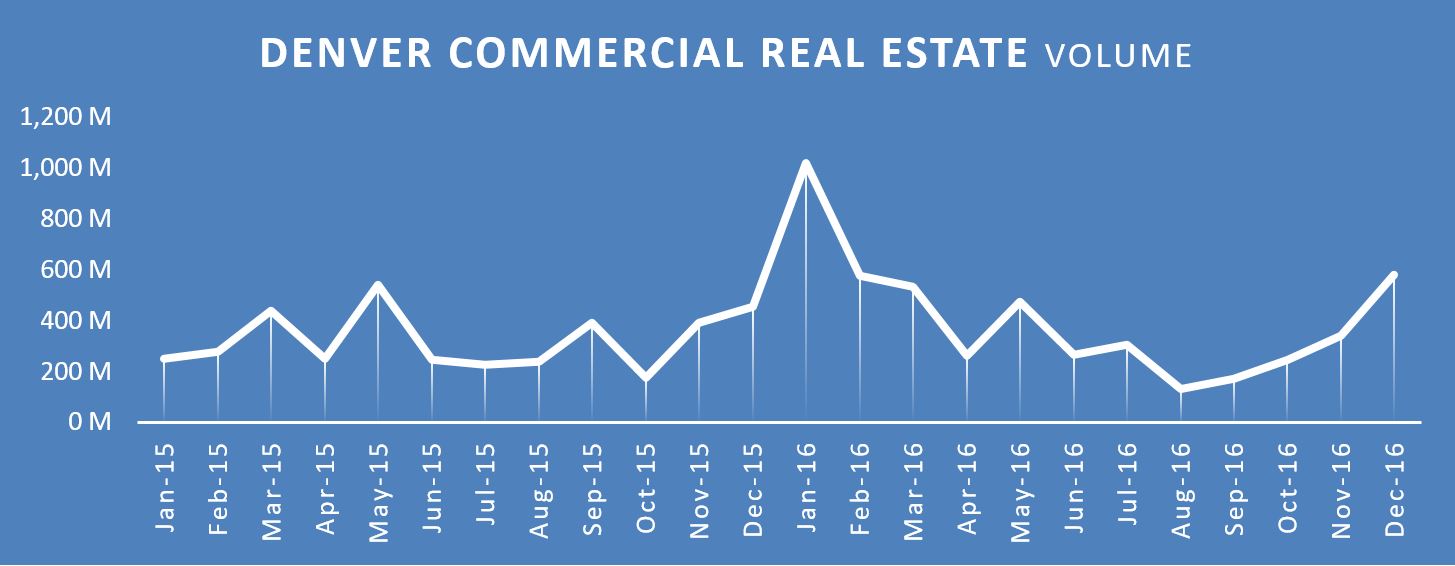

Historical Volume

When we look at the the past two years, January 2016 stands out as a record month in terms of total sales volume. This is due primarily to four significant multi family transactions that account for just over $543M. To put this in prospective, these four transactions account for 11% of the total commercial volume in Denver county for 2016, and it makes up 23% of the annual total for multi family segment.

All four of these transactions had key locations as they are located near DIA, Coors Field, Saint Joseph’s Hospital, and the Denver Tech Center.

Amazon?

Amazon?